Table of Contents

Loans can help response to an emergency, consolidate debt and even fund major purchases without the use of credit cards. But it is difficult to be approved for unsecured loans with bad credit score. In this article, you will discover 7 loans bad credit for which consumers can be approved, even those who have already faced challenges getting approved for loans due to limited credit history or problems in their credit reports.

If you need to get approved for unsecured loans for bad credit, keep reading. It is designed to help borrowers with poor credit to find lenders that are most likely to get them approved.

In addition, at the end, you will discover some simple tips you can use to get approved for almost all types of loans even if your fico score is poor.

Here are 7 Best PERSONAL LOANS FOR BAD CREDIT

7. LendingClub Loans for Bad Credit

LendingClub is a standard online lending company offering high amount of loans. It doesn’t publicly share any required minimum credit score, but interest rates for borrowers with bad credit can be high, ranging from 6.95% to 35.89% APR. Likewise, required origination fee can be 1% to 6% of your loan amount. It offers 3 and 5 years repayment options, which help borrowers to keep relatively low monthly payments. This company has long history of online lending.

LendingClub Loan Details

- Loan amounts: Least of $1,000 to maximum of $40,000

- Fixed APR range: From 6.95% – 35.89%

- Variable APR range: Doesn’t offer variable interest rates

- Origination fee: Between 1% & 6%

- Loan terms: 36 months to 5 years

- Recommended credit score: Either fair or better

- Time to receive funds: Minimum of four business days

- Late fee: Either $15 or 5%.

6. OneMain FINANCIAL Loans for Bad Credit

OneMain Financial offers different types of loans, including unsecured personal loans, to individuals with poor fico score. No minimum credit score is required to apply for a loan. The loans come with an origination fee ranging from $25 to $300 or 1% to 10% of your loan amount based on your state. Minimum and maximum loan amounts also vary by state but in general they range between $1,500 & $20,000.

OneMain Financial Loans Features:

- Various repayment terms that borrowers can choose from

- Fixed interest rate which help to prevent payment shocks in case rates rise

- Same-day approval and funding in certain cases.

- Loan amounts: Range from $1,500 – $20,000

- Fixed-APR range: From 18% – 35.99%

- Variable-APR range: Does not provide variable interest rates

- Loan terms: 2 – 5 years

- Origination fees: $25 – $300 or 1% to 10% of approved loan amount

- Late fees: Charges $5 to $30 with 1.5% to 15% of loan amount

- Time to receive funds: Minimum of one business day

- Recommended credit score: Usually poor or better credit score.

- AVANT Loans for Bad Credit

Avant is also an online lender that advertises quick funding for personal loans. There is no minimum credit score required, and any consumer can freely apply. One thing is that, those with Fico credit scores exceeding 600 are more likely to get approved and qualified for reduced interest rates.

Avant Loans Details

- Loan amounts: $2,000 – $35,000

- Fixed-APR range: 9.95% – 35.99%

- Variable-APR range: Doesn’t offer variable interest rates

- Loan terms: 2 to 5 years

- Origination fee: can be up to 4.75%

- Late fee: About $25

- Time to receive funds: One business day minimum

- Recommended credit score: Either fair/better.

- PEERFORM loans for Bad Credit

Peerform is perfect for Credit Card Consolidation. If you are struggling with credit card debt, consolidation of your loans can help to regain control over your debt. Although poor credit is accepted, to qualify for Peerform loan, your report must be free of delinquent payments in the past 12 months. Peerform’s loans last for 3 to 5 years, with no prepayment penalties and no late fee. They deduct origination fees from the loan once it is credited to borrower’s account.

Peerform Loan Details

- Loan amounts: $4,000 – $25,000

- Fixed-APR range: 5.99% – 29.99%

- Variable-APR range: No variable interest rates

- Loan terms: 3 or 5 years

- Origination fee: From 1% – 5%

- Late fee: Either 5% or $15

- Time to receive funds: Within three days

- Recommended credit score: No minimum score required.

3) LENDINGPOINT Loans for Poor Credit

Lendingpoint is best for Installment Loans. All of the lenders mentioned here offer installment loans, but LendingPoint gives a high degree of flexibility to your installment payments. Therefore, you can choose between monthly and biweekly installment payments, depending on your financial situation.

LendingPoint Loan Details

- Loan amounts: $2,000 – $25,000

- Fixed-APR range: 9.99% – 35.99%

- Variable-APR range: Does not offer variable interest rates

- Loan terms: 2 to 4 years

- Origination fee: Between 0% & 6%

- Time to receive funds: One business day minimum

- Recommended credit score: 585 and above.

2. LOCAL BANKS AND CREDIT UNIONS: Best for Low Interest Rates

In the world of online banking & peer-to-peer (P2P) lending, credit Unions could seem irrelevant. But they are still helpful, if you particularly have bad credit. The best offers advertised online are only available to borrowers with excellent credit. Whereas, your local credit union might be willing to serve the community and help borrowers who have low credit scores.

Your credit union, being a non-profit-making institution, might be a good choice. Credit unions are unique, as they may offer Payday Alternative Loans (PALs) in addition to personal loans. Depending on your credit score, those small, short-term loans might be better than anything else available.

Here are the top 5 best Credit Unions for Personal Loans:

- Ent Credit Union

- Visions Federal Credit Union

- Logix Federal Credit Union

- Members 1st Federal Credit Union

- SchoolsFirst Federal Credit Union.

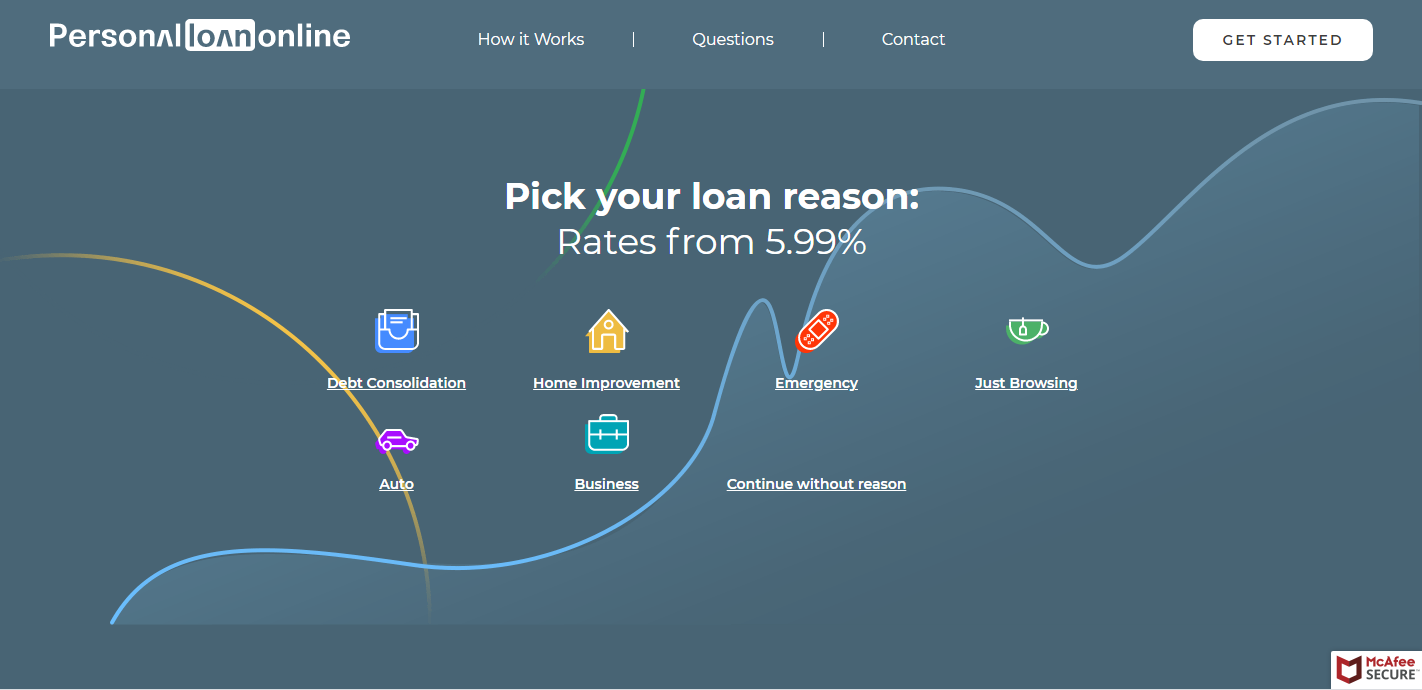

1. Personalloanonline.net: Online indirect lender

This website is a top choice when it comes to the selection of online lenders offering loans to consumers with bad credit. An individual can obtain personal loans to take care of any personal expense.

Personalloanonline.net is not a direct lender or lending partner and doesn’t make loan or credit decisions. This website only connects interested people with approved lenders or lending partners.

The major offers from personalonline.net for individuals with bad credit include:

- Loan amount: The range of money that can be borrowed through this network is from $100 – $35, 000.

- APR: An APR runs generally between 5.99% to 35.99%. Please read the loan agreement of each lenders carefully as the APR may differ from what is listed on this site.

- Repayment term: Personal loans generally have 61 days minimum and a 72 months maximum repayment term

- Credit score: Credit checks are mostly done by one of the major credit bureaus like Experian, TransUnion, and Equifax, or by alternative credit bureaus like DP Bureau, Teletrack etc. You can authorize Personalloanonline.net to share your information as well as credit history with their approved lenders and lending partners.

- Extra fees: Loan fees, including late payment charges and interest rates, are solely determined by the lender or lending partner that issues the loan.

- Availability: The service of this website is not available in all states. If you request to link with a lender or lending partner in a particular state where such loans are not available your application may be rejected.

In addition to these lenders, here are some simple tips to get approved for personal loans even when your credit score is low.

- Know your fico score so that you can take appropriate decisions

- Dispute or pay Off bad reports if necessary

- Ask a responsible person with good credit to add you as an authorize user.

- Reduce or Pay off your credit card balances

- Ask your credit cards issuers to Increase your credit limit

- Open a new credit card. Consider a secure card if you are not approved for a non-secure

- Finally, if these steps above are not enough, apply with a Co-signer.