Table of Contents

Solana is a high-speed blockchain known for its low transaction fees. With a theoretical speed of up to 65k transactions per second and a practical speed of several thousand, it becomes a serious competitor to Ethereum and Bitcoin and a pick platform for traders looking to maximize earnings.

However, like any other blockchain platform, Solana is characterized by instability and market fluctuations. Without adequate reaction time, opportunities for profitable deals can disappear in the blink of an eye.

Many traders have already adopted crypto trading bots, and for a wide range of trading strategies, automated trading software has become not just an advantage but a bare minimum.

In this guide, we will provide you with a clear plan for Solana custom crypto trading bot development, covering all stages, from strategy definition to development, testing, and deployment.

What Is a Solana Trading Bot?

In simple terms, a Solana trading bot is an automated software program designed to execute buy and sell orders on the Solana blockchain based on certain predefined rules or algorithms.

Rather than executing a trade manually, it observes market situations, looks into price movements, and directly communicates with the decentralized exchanges (DEXs) developed on Solana, for example, Raydium, Serum, or Jupiter.

What makes trading bots on the Solana platform particularly effective is the network itself.

Solana has incredibly fast confirmation speeds of transactions and minimal fees that enable the bot to perform many trades per day with the ability to respond immediately to market changes while minimizing any losses resulting from slippage or network congestion.

Furthermore, in today’s Solana ecosystem, many bots are built with features adapted to current market realities. They track new token launches on Pump.fun, apply rug pull filters to avoid suspicious or low-quality assets, and use Jito tips to increase the chances that time-sensitive transactions are processed quickly.

These capabilities are especially important for strategies that depend on fast execution and early market entry.

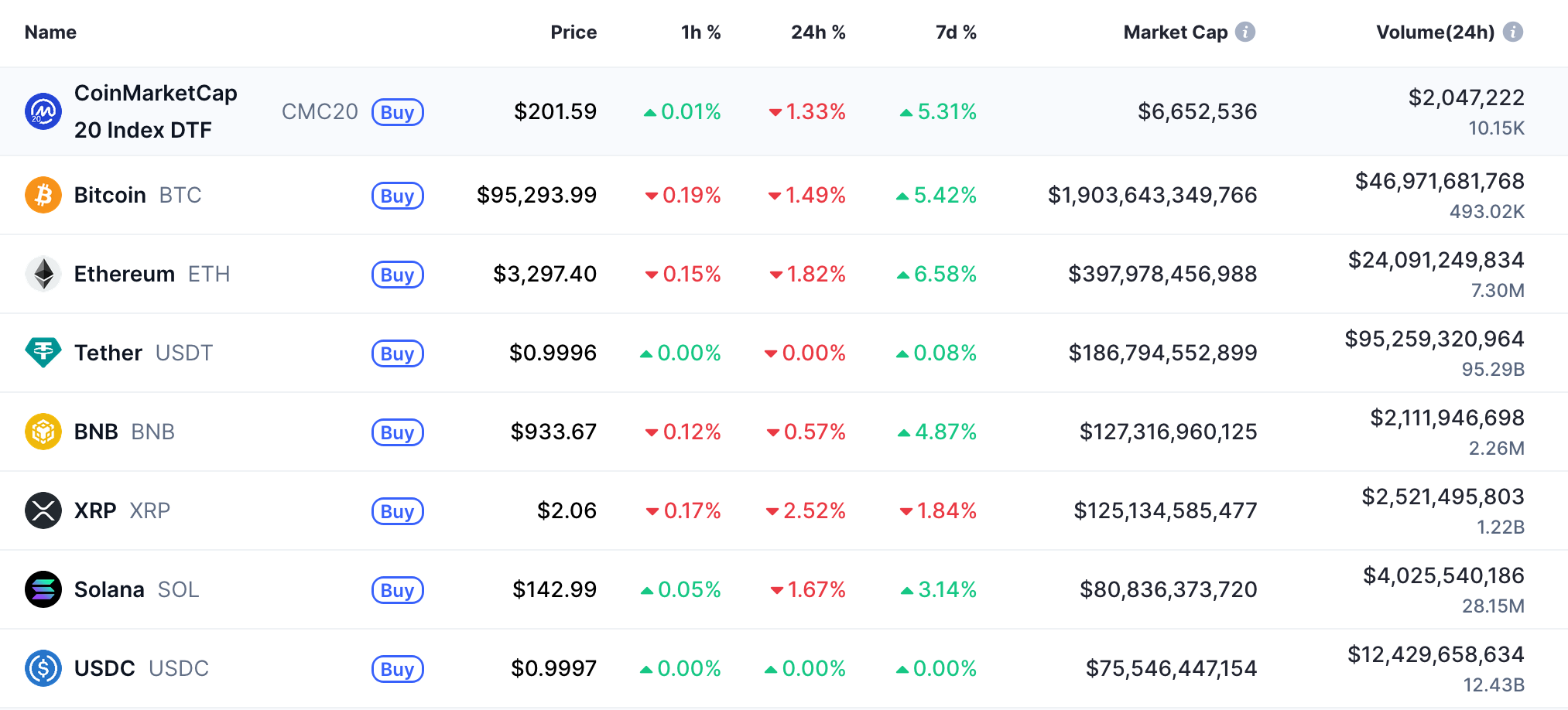

Solana’s Position Among Other Blockchain Platforms, CoinMarketCap

How Solana Trading Bots Work

To work exactly as they are intended to, Solana trading bots follow a continuous cycle of data collection, analysis, and execution. Yet, thanks to Solana’s high throughput and low latency, this entire process can happen within milliseconds.

Data Collection

The bot constantly gathers on-chain and market data, such as token prices, order book depth, liquidity levels, and recent transactions. This data is usually fetched through Solana RPC endpoints or real-time WebSocket connections.

For example, a bot may subscribe to price updates from a Raydium pool or watch new token mints and swaps as they appear on-chain. Using WebSockets or Geyser streams allows the bot to receive updates instantly instead of relying on slower polling.

Signal Generation

When the data is collected, the bot analyzes it to determine whether market conditions match the chosen strategy. This often involves technical indicators such as moving averages for trend detection, ADX for trend strength, or ATR for volatility measurement.

For instance, a momentum bot might generate a buy signal when a short-term moving average crosses above a long-term one, while an arbitrage bot compares prices across multiple DEXs to detect profitable discrepancies.

Trade Execution

Once a signal occurs, the bot constructs and submits transactions to the blockchain, engaging with DEX smart contracts on platforms like Serum, Raydium, or Jupiter, a process made possible by Solana smart contract development.

Fast RPC endpoints are crucial at this stage, as even small delays can lead to missed opportunities or increased slippage, especially in high-frequency trading or scalping strategies.

Risk Management

To protect capital, the bot applies predefined risk controls to every trade. This includes stop-loss and take-profit levels, limits on position size, and rules that prevent overexposure to a single asset or market condition.

For example, a bot may automatically close a position if the price drops by a certain percentage or pause trading entirely after a sequence of losses. These safeguards help ensure that automation reduces risk rather than amplifying it.

| Advantage | Benefit |

| Low fees | Supports frequent, cost-efficient trades |

| Fast execution | Reduces slippage |

| High throughput | Enables advanced strategies |

| On-chain execution | Improves visibility |

| Real-time data | Faster reaction to market changes |

| Scalability | Handles multiple markets at once |

Advantages of Solana Trading Bots

Types of Solana Trading Bots

According to on-chain data, bots running on the Solana network have collectively generated more than $1 billion in revenue.

But Solana trading bots are typically created around a specific execution model and data flow. This is why there are many subclasses of bots.

Each type counts on different on-chain signals, latency requirements, and interaction patterns with Solana programs and DEX smart contracts.

Sniper Bots

Sniper bots focus on ultra-fast execution triggered by on-chain events such as new token mints, liquidity pool creation, or the first swap in a newly deployed market.

Technically, these bots subscribe to blockchain data using WebSocket or Geyser streams to detect program logs and account state changes.

When an event is detected, the bot instantly constructs and signs a transaction, often using prebuilt instructions and prioritized fees to outpace competing traders.

Arbitrage Bots

Arbitrage bots compare prices, liquidity depth, and swap routes at several Solana DEXs. They integrate price feeds from Raydium, Serum, Orca, or Jupiter and calculate potential profit after accounting for fees and slippage.

More advanced bots perform multi-hop or triangular arbitrage by chaining several swaps into a single transaction. To reduce execution risk, these bots often use atomic transactions, ensuring that either all exchanges are successfully completed or the entire transaction is canceled.

Grid Bots

Grid bots divide a given price range into several levels and place buy and sell orders at each level.

On the Solana network, this typically involves managing multiple open orders on order book-based decentralized exchanges like Serum, or simulating limit orders on automated market makers (AMMs).

The bot watches executed orders through account updates and dynamically rebalances the grid as prices change.

DCA Bots

A DCA bot automatically buys (or sells) a fixed amount of a token at regular intervals, no matter what the price is at that moment. This spreads out the investment over time, reducing the impact of short-term price swings and avoiding the risk of trying to “time the market.”

TWAP and VWAP Bots

TWAP (Time-Weighted Average Price) and VWAP (Volume-Weighted Average Price) bots execute large orders gradually instead of all at once to prevent the trade from moving the market too much and help get a better overall price level.

For instance, instead of buying 10,000 SOL in one transaction, a TWAP bot might buy 1,000 SOL every hour for 10 hours.

VWAP bots are similar, but instead of dividing trades purely by time, they adjust based on market volume. The bot looks at how much trading activity is happening and executes more when liquidity is high and less when the market is thin.

Copy Trading Bots

Copy trading bots monitor specific wallet addresses or smart contract interactions on Solana. Using transaction subscriptions or account change listeners, the bot detects trades made by tracked wallets and replicates them proportionally.

Step-by-Step Guide to Building a Solana Trading Bot

Digging into the Solana trading-bot space will show you that it is already abounding with ready-made solutions (Trojan, Photon, Axiom Trade, GMGN AI, BullX NEO, etc).

So why not take advantage of it? In reality, current tools on the market are often too basic to work well in this market. Custom bots can do more advanced things like tracking volume spikes, analyzing trends, reacting to social sentiment, and so on.

Yes, blockchain development services take a bit of effort, but once you’ve got your own setup, you’re not stuck relying on generic signals that everyone else is using.

1. Define Your Strategy

The process starts with specifying clear trading ideals and constraints. This includes profit targets, acceptable drawdowns, position sizing rules, and stop conditions.

At this stage, the main strategy is selected, such as arbitrage, momentum, grid strategy, cost averaging, or sniper trading, as well as the market signals that will initiate trades.

2. Choose Your Development Provider

Making a trading bot for Solana involves complex steps that can be performed by a professional developer, such as SCAND, a company providing full-cycle services. First, the developer selects the technology stack for critical parts of the system, transaction logic, and analytics or backtesting.

Then, they set up the development environment, installing the Solana SDK, configuring wallets, and connecting to Devnet or Testnet for secure testing, using environment variables that simulate production conditions.

Next, the developer integrates market data and APIs to obtain real-time prices, liquidity information, and historical data.

Finally, they create the bot’s logic and execution modules, converting strategies into signals using indicators, executing orders on DEXs, and applying risk management mechanisms such as stop-losses and position limits.

3. Testing and Backtesting

Before deployment, the bot should always undergo testing at several levels. Unit tests verify individual components, while backtesting evaluates the strategy’s effectiveness using historical Solana data.

Trading on the testnet, in turn, simulates real trading conditions without financial risk, helping pinpoint logical errors, time-to-execution issues, or unexpected behavior.

4. Deployment and Monitoring

The final step is deployment to a production environment. Again, the development provider deploys the bot to a production environment using a stable private RPC provider and sets up monitoring systems to watch performance, transaction success rates, and error logs.

They also configure alerts to detect abnormal behavior and provide updates to keep compatibility with the Solana network and protocol changes.

Common Challenges & Best Practices

Developing and running Solana trading bots often hides several technical and operational obstacles that require careful planning.

The first problem to think over is wait time. Many strategies depend on responding within milliseconds. Slow RPC endpoints, network delays, or weak transaction construction can cause bots to miss trades or carry out them at worse prices.

To tackle such an issue, the best practice is to use private or high-performance RPC providers, rely on WebSocket or Geyser streams instead of polling, and optimize transactions ahead of time.

The second problem, but by no means less important, is dependability. Solana markets change extremely fast, and bots that digest stale or vague data can breed incorrect signals.

In this situation, the most effective solution would be to use real-time data feeds, check prices against the data on the blockchain, and implement logic that can handle short-term price discrepancies and/or asynchronous problems with RPC requests.

Tools and Libraries for Solana Bots

Building a fully functional trading bot for Solana requires a combination of blockchain libraries, infrastructure services, and real-time data tools.

- @solana/web3.js: This is the primary JavaScript/TypeScript SDK for interacting with the Solana blockchain. It’s used for managing wallets, creating and signing transactions, subscribing to account changes, and interacting with Solana programs. Most Solana bots use this library to build transactions and execute operations on the network.

- RPC Infrastructure (Chainstack, QuickNode, private RPCs): RPC endpoints act like a gateway between the bot and the Solana network. Public RPCs would work great for development and testing, but production bots usually rely on private RPC providers to downsize latency and increase request rate limits.

- WebSocket and Geyser Plugins: WebSocket connections enable real-time subscriptions to account updates, price changes, and transaction events, removing the need for constant polling. Geyser plugins provide even faster access by streaming data directly from Solana validators, which is particularly valuable for sniper bots, arbitrage bots, and memecoin bots that depend on immediate market signals.

- DeFi and Market Data API: APIs (e.g., Jupiter v6, Jupiter Aggregator, Bitquery) not only simplify access to aggregated price data, swap routes, liquidity information, and historical market data, but also reduce development complexity and help bots make better trading decisions on DEXs.

- Python Solana Bot Tooling: Though JavaScript and TypeScript dominate execution logic, Python is commonly used for strategy research, analytics, and backtesting. Python Solana bot setups are especially useful for modeling strategies before deploying them into production environments.

- Authentication and Security Tools: JWT-based APIs and secure key management solutions are often used to protect access to infrastructure services and sensitive endpoints. Proper authentication ensures that bot operations remain isolated and secure, especially in multi-environment or team configurations.

- Development and monitoring tools: IDEs such as VS Code, version control systems such as Git, and logging or alerting tools are essential for supporting and operating bots in a production environment. Monitoring helps identify failed transactions, RPC issues, or anomalous trading behavior before they lead to losses.

Security Considerations in Solana Trading Bot Development

Security is a basic factor of building trading bots, as these systems manage real funds and interact directly with on-chain programs. Protecting private keys, preventing unauthorized access, and mitigating operational risks are essential to ensure safe and sound bot operation.

Private keys should never be stored in plain text or hardcoded into the code. Using hardware wallets, encrypted local storage, or secure vaults provides a strong layer of protection.

For bots that conduct frequent transactions, hot wallets with strict limits can be used, while larger reserves should be stored in cold wallets to minimize risks.

Implementing multi-signature (multi-sig) wallets adds another layer of security. By requiring multiple confirmations for high-value transactions, bots reduce the risk of single points of failure or key compromise.

In addition, automated security measures such as stop-loss thresholds, trade limits, and automatic circuit breakers help prevent uncontrolled trades during unexpected market volatility or software errors.

Even in decentralized environments like Solana, regulatory compliance remains important, especially for bots handling client funds or large trading volumes. Monitoring legal requirements ensures that operations comply with local regulations and avoid potential penalties.

Solana Trading Bot Development Trends

The trading bots development process will remain to be unraveled with the advent of artificial intelligence, decentralized architecture, and low-latency trading.

Bots will rely heavily on AI and ML algorithms for strategy adaptation, pattern recognition, and optimizing trade timing.

In the future, trading bots will also no longer rely on a single server or control point. Due to decentralized management, monitoring, decision-making, and trade execution will be spread across multiple components or locations.

Having RPC servers located close to the Solana network, along with well-optimized infrastructure, will allow bots to send transactions and receive data much faster.

This speed is especially important for sniping and arbitrage strategies, where reacting even milliseconds earlier can determine whether a trade is successful.

At the same time, modular frameworks will simplify bot development. Instead of making everything from scratch, developers will be able to combine ready-made modules for trading strategies, risk management, and execution logic, which speeds up development and reduces errors.

Frequently Asked Questions (FAQs)

What exactly is a Solana trading bot?

It’s a program that trades on Solana for you. Instead of clicking “buy” or “sell” yourself, the bot watches the market, follows the metrics you set, and executes trades automatically, even when you’re offline.

Do I really need a private RPC to run one?

For learning and testing, public RPCs usually work fine. But for real trading on mainnet, a private RPC is strongly recommended. It’s faster and more stable, which matters a lot for strategies where speed makes a difference.

Which programming language should I use for a Solana bot?

There’s no single best choice. Rust is used when speed really matters, TypeScript running on Node.js with @solana/web3.js is popular for building the bot itself, and Python is often used for testing ideas or backtesting. Many bots use more than one language.

Can I test my bot before using real money?

Yes, and you should. You can test your strategy using past market data or run the bot on Solana’s test networks to see how it behaves without risking real funds.