Canadian renters are spending an ever-growing amount of their paycheques on rent, even though they may qualify for a mortgage.

Nationally, they are spending 37.6 per cent of their income on rent, according to analysis from SingleKey Inc., falling just below the 40 per cent “crisis” level.

But Toronto renters have already reached the crisis level by spending 41.1 per cent of their salaries on housing, or an average of $2,899 per month.

The average rent in Canada is $2,200 per month, with Vancouver’s $3,095 per month rate being the most expensive city for renters.

It’s no wonder renters have a hard time paying the bills. A recent Equifax Canada report said non-mortgage holders were twice as likely to miss a credit payment compared to those with a mortgage.

“While the overall delinquency rate appears to be levelling off, the underlying story is far more complex,” Rebecca Oakes, vice-president of advanced analytics at Equifax Canada,

. “We continue to see a growing divide between mortgage and non-mortgage consumers, and continued financial strain among younger Canadians, who are facing a slower job market and rising costs.”

Overall, 1.4 million Canadians missed a credit payment in the second quarter of 2025, while consumer debt climbed to $2.58 trillion, Equifax said.

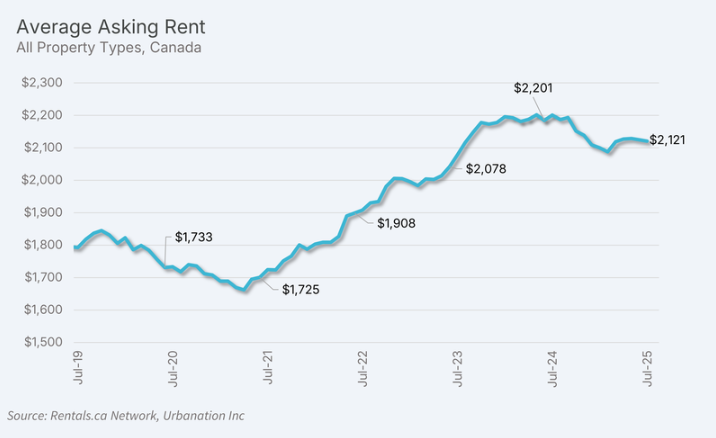

This comes despite rents for condos and apartments falling 3.6 per cent year over year in July, marking the 10th consecutive month where Canada’s rents have fallen year over year, according to Rentals.ca data.

The good news for renters is that it doesn’t look like rent will be going up anytime soon.

“The 3.6 per cent year-over-year rent decline in July is greater than the 2.7 per cent decline recorded in June and suggests that rent declines are likely to continue compounding,” Rentals.ca said in its report.

Nevertheless, asking prices remain 11.1 per cent higher than three years ago,

.

Despite the challenges of paying their bills, many renters might still qualify for a mortgage. The average credit score among renters is 694, SingleKey said, which is above the 680 threshold needed for approval at many major banks.

Renters in Toronto and Vancouver have credit scores of 729 and 730, respectively, which are significantly above the mortgage approval threshold.

Alberta has the lowest provincial credit rating among renters at 681, so the average renter in every province has a credit score needed for mortgage approval.

Sign up here to get Posthaste delivered straight to your inbox.

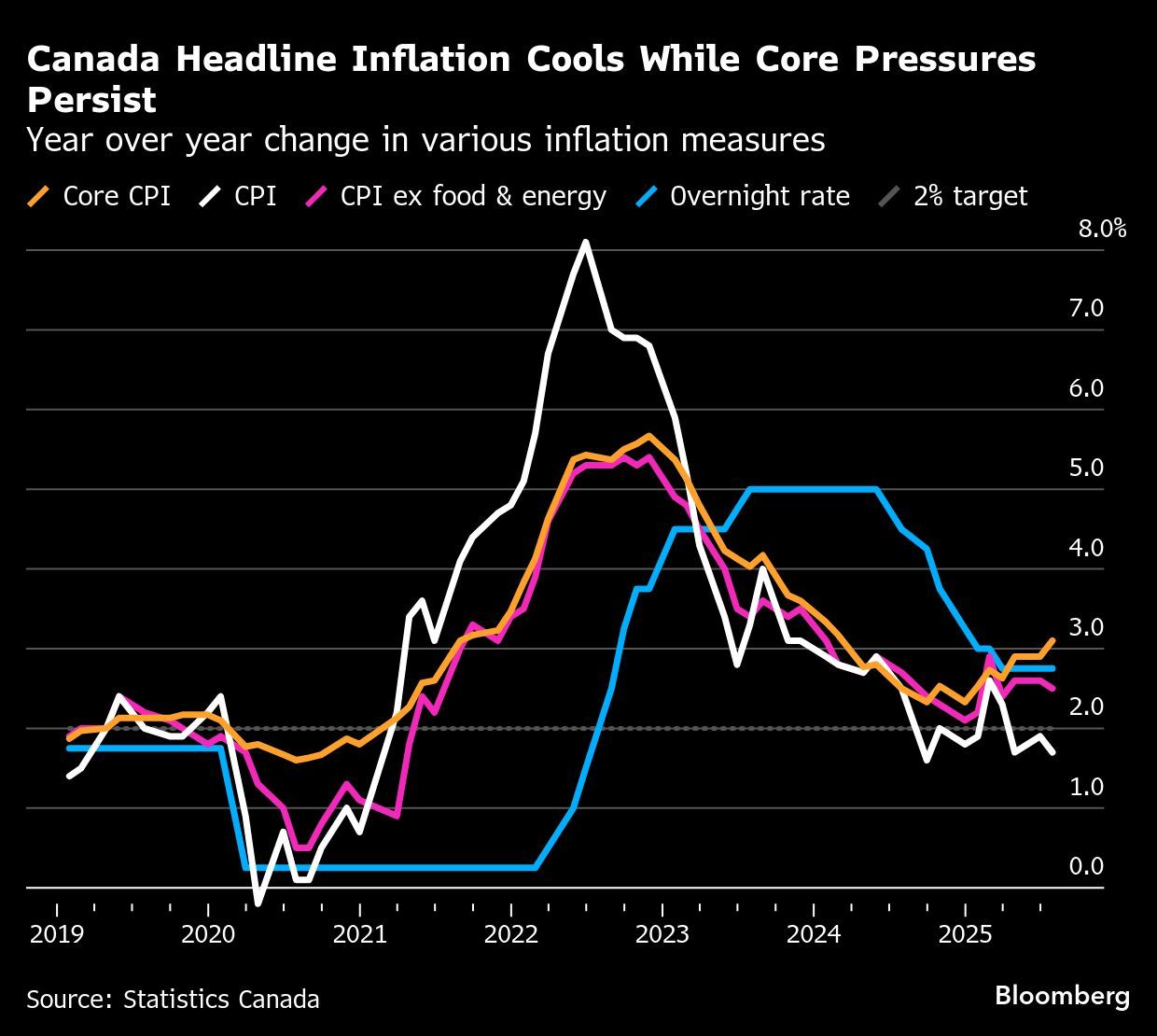

Canada’s inflation rate slowed down to 1.7 pr cent in July from 1.9 per cent a month prior, driven by a drop in gasoline prices due to the removal of the federal carbon tax.

Overall, gas prices fell 0.7 per cent on a monthly basis.

Despite the drop in headline inflation, seven of the main components rose in the month. The consumer price index excluding gasoline remained flat at 2.5 per cent.

Core inflation, which the Bank of Canada tends to focus on when making monetary decisions, remained around three per cent.

Read more here.

- 2 p.m.: United States Federal Reserve to release its minutes for its July 30 interest rate hold

- Today’s Data: New housing price index for July

- Earnings: Lowe’s Companies Inc., Target Corp.

- Canada’s inflation cools to 1.7% as gasoline prices drop

- Inflation reading won’t ‘move the needle’ for Bank of Canada, says economist

- Canada’s trade diversification push will only ‘partially offset’ decline in U.S. trade

- Air Canada to resume service after reaching agreement with union

Canadians looking for a deal on trips to the U.S. may be in for a rude awakening as many airlines have already shifted their plans away from the U.S. and more toward Mexico and the Caribbean. That said, those willing to bypass a U.S. boycott can find hotel deals. U.S. travel faces cost headwinds as the loonie lags behind the greenback, but places like Japan, New Zealand and Argentina offer some currency relief as well.

Read more here.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s

Financial Post column

can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his

mortgage rate page

for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s

for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at

.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here